Car Insurance: Protecting Your Vehicle And Peace Of Mind

Customer Service and Claims Experience in Australian Car Insurance

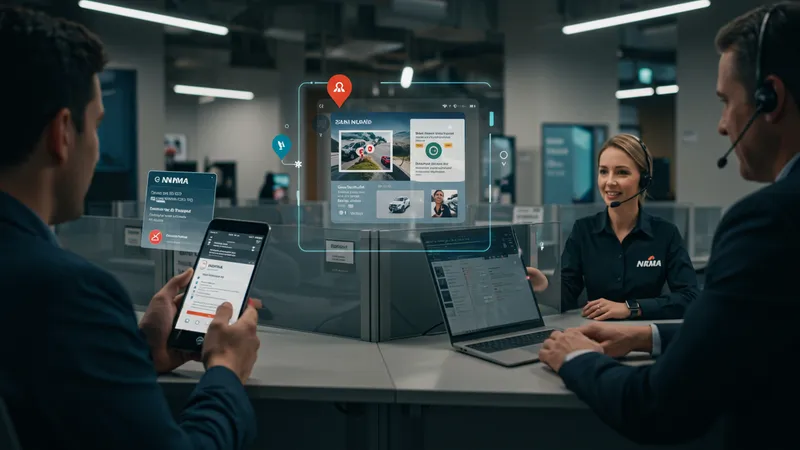

The level of service offered by insurance providers has become a decisive factor for Australians seeking true peace of mind. Policyholders increasingly look for streamlined claims processes, clear communication, and accessible support. NRMA stands out for its responsive, local call centres and wide repair network, which helps reduce downtime after an incident. AAMI has won customers with a user-friendly digital claims process and their reputation for prompt resolutions.

Budget Direct has invested in mobile-first technology, offering customers the ability to submit claims, upload damage photos, and track progress online. The convenience of digital claims is rated highly by tech-savvy Australians, who appreciate managing policies and claims at any time of day. However, those preferring personal contact might favour providers like NRMA, where in-person claims assistance is readily available.

Turnaround times for claims approval and repair authorisation are crucial. Delays can disrupt everyday life, so insurers with well-established repairer networks generally deliver smoother, faster outcomes. Rental car arrangements, progress updates, and repair guarantees further differentiate experiences across providers. Australians are increasingly vocal about customer service—online reviews, industry awards, and peer recommendations play a growing role in shaping perceptions.

Ultimately, a provider’s claims track record reveals much about its dedication to protecting customers’ vehicles and mental comfort. Fast, fair, and transparent claims handling enables drivers to recover with minimal hassle—a critical, though sometimes underappreciated, dimension of comprehensive car insurance in Australia.