Compare The Best Short-Term Car Insurance In The UK

Pricing and Value Comparison for Short-Term Car Insurance in the UK

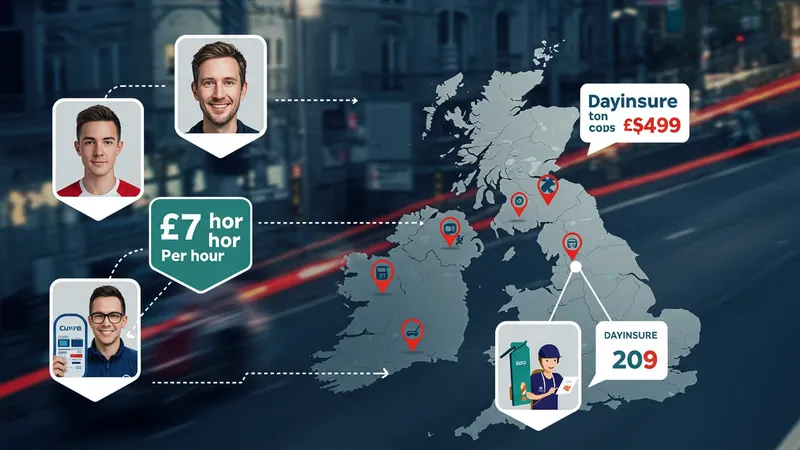

The price you pay for short-term car insurance in the UK isn’t just a flat fee—it’s the outcome of several key factors: driver age, driving history, vehicle type, location, and duration of cover. For example, Cuvva may quote as low as £7 per hour for drivers over 21, while Dayinsure’s day rate starts at £25. Zego’s hourly pricing opens access to those needing coverage for gig work or brief personal trips, which is rare among traditional providers.

Tempcover and GoShorty offer value for drivers looking at periods longer than a single day, with decreasing per-day costs for policies of a week or more. Insure4aDay and Esure Temporary Car Insurance position themselves slightly higher on price but may offer enhanced customer service and broader coverage options as justification. Drivers must weigh whether the additional features offset the higher daily premium.

For anyone under 25 or without a lengthy driving record, premiums across all providers climb sharply, with GoShorty and Swiftcover sometimes offering more inclusive options for young drivers than their competitors. This underlines the importance of inputting your exact data for an personalised quote rather than generalising via headline rates found across the UK market.

Temporary policies can also offer a financial edge when compared to the costs of amending or cancelling annual insurance to accommodate new driving needs. UK drivers increasingly appreciate how these flexible products solve irregular, short-term needs without risking no-claims bonuses on longer policies or incurring punitive admin charges for changes.