Compare The Best Short-Term Car Insurance In The UK

User Experience and Application Process for UK Short-Term Providers

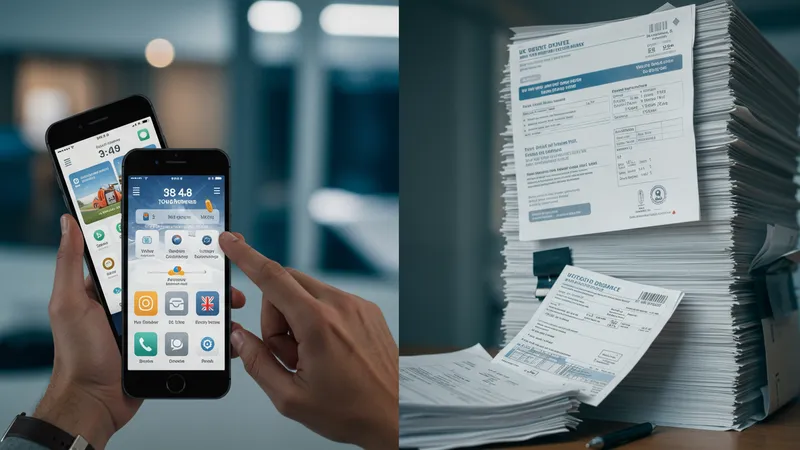

Modern UK insurance providers such as Cuvva and Tempcover have invested heavily in user-friendly apps. For many drivers, the entire application—quotation, payment, policy document, and even claims notification—happens on a smartphone within minutes. This digital-first approach stands in sharp contrast to the slower, paperwork-heavy processes of legacy insurers and is especially valued in urgent situations like unexpected vehicle use or last-minute rentals.

Meanwhile, brands like Aviva and Dayinsure cater to customers who favour web-based management. Their portals are tailored to speedy application times, often under 10 minutes, while maintaining traditional levels of service help. Swiftcover and heycar Temporary Cover blend both app and browser technologies, trying to balance ease-of-use with thorough policy information for peace of mind.

Customer reviews highlight real differences in the responsiveness and clarity of these digital journeys. Cuvva’s chat-based support system enables on-the-go assistance, while others gravitate toward phone support or email communication. This variety allows UK drivers to prioritise what matters—whether instant policy issue, clarity of documents, or accessible claims support.

Providers like GoShorty and Zego are continually adding new features, from real-time policy tracking to direct integration with telematics or rideshare platforms. These innovations directly respond to the needs of modern UK motorists and hint at the coming evolution in short-term car cover services.