Credit Cards & Loans: Smart Borrowing For Financial Freedom

Comparing Credit Card Options for Financial Freedom in Australia

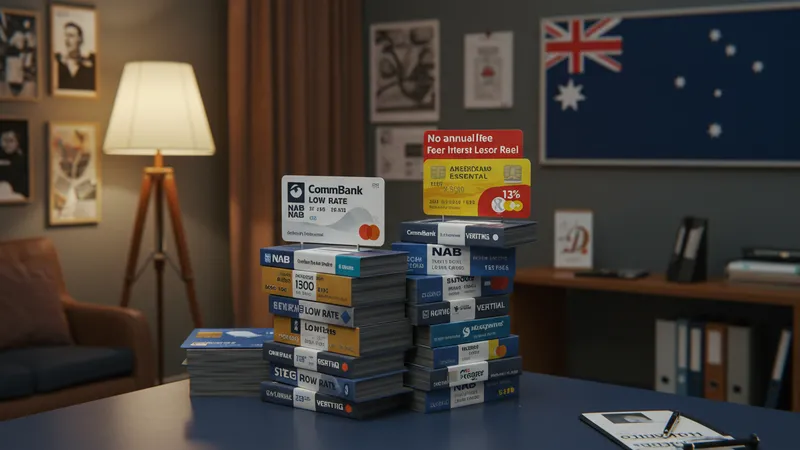

When evaluating credit cards for smarter borrowing in Australia, two factors almost always rise to the top: interest rates and annual fees. Low-rate cards like the CommBank Low Rate Credit Card and NAB Low Rate Card are designed for those who may occasionally carry a balance and wish to minimize interest expenses. By focusing on products with rates around the 13% range and moderate annual fees, Australians can limit the long-term cost of short-term borrowing—much lower than the typical 20%+ seen on many rewards cards.

No annual fee options—such as the American Express Essential Card and St.George Vertigo—represent a clever solution for people who pay balances in full each month and seek to avoid extra charges. For those who strictly repay before the due date, the annual fee plays a bigger role in total costs than the advertised interest rate. These cards let users sidestep yearly fees entirely, keeping borrowing simple and affordable for everyday transactions.

Reward cards, while often featuring higher standard purchase rates (for example, the Citi Rewards Credit Card), stand out for users keen to earn points toward travel, shopping vouchers, or cashback. However, these options are best utilized by disciplined spenders who clear their balance monthly—otherwise, interest charges quickly outweigh the value of earned rewards. Macquarie’s Platinum Card, combining a competitive rate with cashback offers, bridges the gap for those who want some perks without sky-high interest.

Context matters: Young professionals, frequent travelers, and families all benefit differently from various cards. University students often gravitate toward low-fee cards with strict spending limits, while families may prioritize rewards tied to groceries or fuel. Matching your typical spending and payment habits with the right product can free up resources for goals beyond servicing debt, illustrating the broader impact of truly strategic card choice.