Growth Of Car Leasing Market

The Hidden Costs No One Talks About

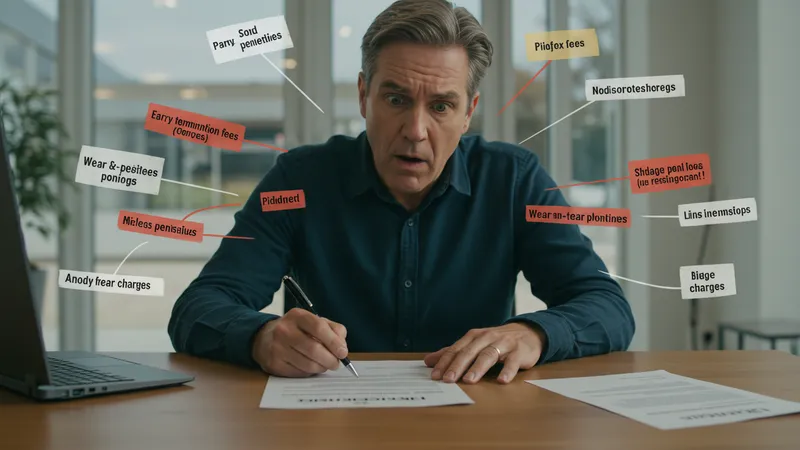

While leasing a car comes with its conveniences, there’s a network of hidden costs that often catch consumers off guard. From early termination fees to mileage penalties, leasing isn’t just a carefree ride. Many are hooked by the prospect of lower monthly payments, unaware of the strings attached. This lack of understanding could derail financial plans for the unprepared. But there’s one more twist…

Maintenance and wear-and-tear clauses can inflate costs unexpectedly. Although leasing might relieve the initial financial burden, returning a car with even minor damages can result in hefty charges. It’s crucial to know the nitty-gritty details of what you’re signing up for. These can vary widely among different leasing companies. But what you read next might change how you see this forever.

One significant worry is the insurance aspect. Leased cars usually require full-coverage insurance, which can be more costly than the insurance needed for owned vehicles. The perception of leasing as a cheaper option gradually fades as these extra costs accumulate. However, there’s a surprising strategy that savvy lessees can employ to minimize these expenses.

In certain scenarios, a well-negotiated lease can indeed be beneficial. Companies like BMW offer unique solutions that mitigate some of these costs, especially for loyal customers. When combined with other flexible options, these can create a more sustainable and cost-effective solution. But there’s a twist in how these deals are structured that every potential lessee should know about…