Home & Auto Insurance Market Insights

The Curious Case of Peer-to-Peer Insurance

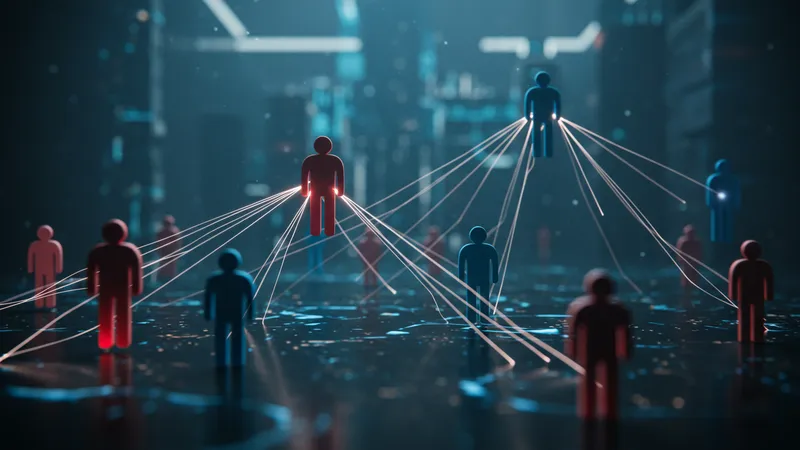

In a world where sharing economies are flourishing, peer-to-peer (P2P) insurance emerges as an intriguing alternative model. With principles rooted in collaboration and shared risk, P2P insurance has the potential to disrupt traditional insurance paradigms.

By grouping individuals with similar coverage needs, P2P insurance aims to reduce costs and eliminate inefficiencies. Policyholders pool premiums to cover claims, promoting transparency and fostering trust among members. This close-knit approach offers a refreshing change, but there’s an element shrouded in mystery…

Large insurers have taken note, experimenting with P2P elements to enhance customer engagement and retention. Incentives for low claim incidents and healthy lifestyles flourished within these systems, encouraging responsible behavior among peers. What remains hidden is the potential for conflict or dissatisfaction should claim behaviors shift unexpectedly.

As more participants join this insurance innovation, the delicate balance between sustainability and fair distribution remains to be seen. There’s still much to uncover in refining this model for broader acceptance and maximizing benefits for all parties involved.