Navigating The Real Estate Landscape: A Comprehensive Guide To Success

The Hidden Costs No One Talks About

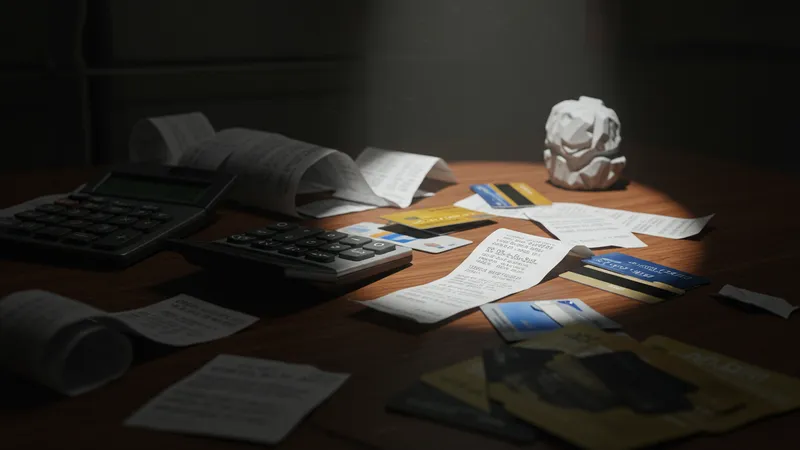

Investors often overlook the peripheral costs associated with real estate investment. Taxes, insurance, and maintenance fees incur additional expenses that can hugely impact profitability. Navigating these hidden costs is a skill in itself.

There are ways to decipher legal jargon and finer contract details, saving potential pitfalls down the line. Successful investors meticulously dissect these documents, uncovering money-saving strategies. Yet, there’s a cost that often goes unnoticed…

The psychological costs of decision-making and negotiation is taxing, albeit underestimated. Being well-prepared can mitigate these impacts significantly. But there’s a dark horse in these considerations that’s commonly ignored…

Opportunity cost—a subtle concept in economics—plays a crucial role in decision-making. Recognizing and managing this can redefine investment returns. Uncovering this notion may just change how you see real estate investment forever…