Personal Loans: Flexible Financing For Your Needs

Eligibility and Application for Thailand’s Personal Loans

Personal loan providers in Thailand maintain clear eligibility criteria to ensure responsible lending. Applicants must typically be Thai citizens aged between 20 and 60, with a stable income source—employed or self-employed. For example, SCB requires a minimum monthly salary of THB 15,000 for salaried individuals, and higher for business owners, ensuring the repayment capability of borrowers.

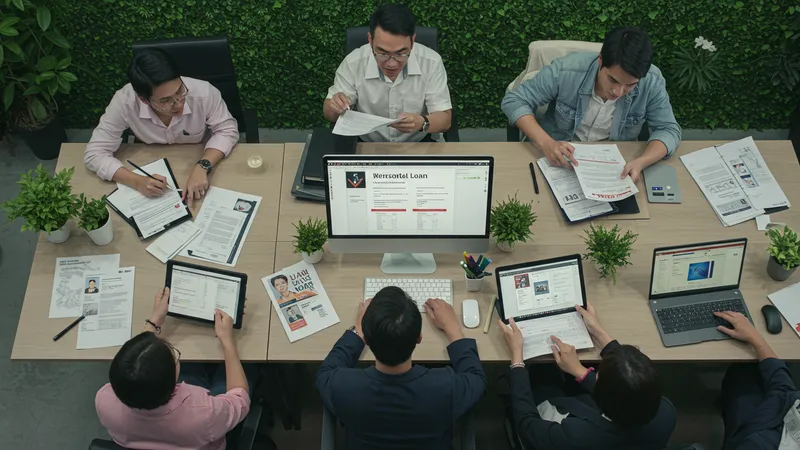

KBank emphasizes simple documentation: a valid personal ID, income proof (such as payslips or bank statements), and occasionally proof of residence. Digital platforms allow applicants to upload these documents online, enabling faster pre-qualification checks and reducing turnaround times. Krungsri further simplifies the process by accepting online applications and offering an initial evaluation within minutes.

Certain features, such as higher maximum loan amounts or better rates, may be unlocked for individuals with stronger credit histories. Lenders in Thailand routinely access national credit bureau data to assess applicants’ financial behavior, ensuring both borrower suitability and risk management. Clear, upfront eligibility requirements make it easier for borrowers to prepare and plan their applications confidently.

Lender-specific perks vary: KBank may offer special campaigns for account holders, SCB supports “top-up” requests for existing customers, and Krungsri sometimes runs seasonal promotions with waived processing fees. Each institution’s application process is designed to minimize friction and support users in every step, setting Thailand’s personal loans apart for their customer-first approach.