Pipe Corrosion In Older UK Homes: Costs, Risks, And Insurance Coverage

Insurance Policy Types and Coverage Gaps for UK Pipe Corrosion

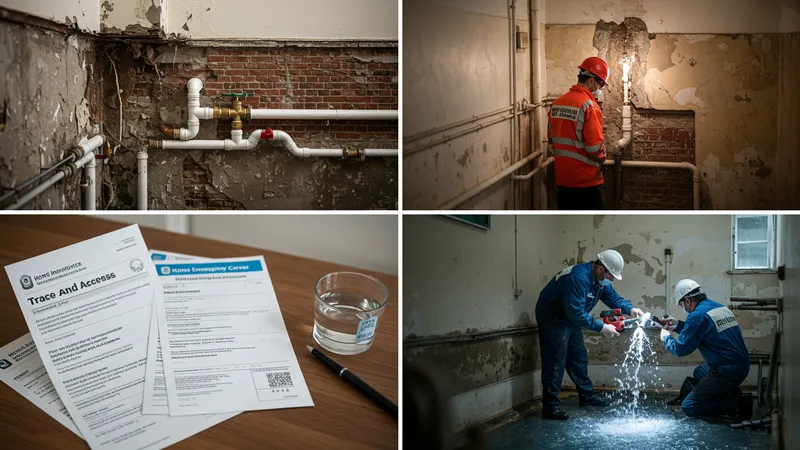

Insurance cover for pipe corrosion in older UK homes varies significantly by provider and policy type. While standard home insurance typically covers water damage from “sudden and unforeseen events,” such as a pipe bursting, gradual damage due to corrosion is often considered a maintenance issue—making it commonly excluded from base cover. To address this risk, some property owners opt for specialist add-ons like “trace and access” or “home emergency cover,” which increase the chance of approval for related claims.

Products such as the British Gas Plumbing & Drains Cover stand out by including emergency callouts and repairs for corroded pipework—particularly valuable for period houses where immediate intervention is needed to prevent water damage escalation. Meanwhile, Co-op Home Insurance policies with “trace and access” options help homeowners locate and fix hidden leaks, a common scenario in Victorian or Edwardian homes where pipe routes are obscured by age-old walls.

Even among comprehensive policies like Direct Line Home Insurance, exclusions for gradual deterioration remain. As a result, experts recommend a careful annual review of all insurance documents. Homeowners may benefit from scheduling regular plumbing surveys and keeping maintenance logs to strengthen their position should a claim for corrosion-related damage arise.

The competitive UK insurance market gives older property owners avenues for protection, but there is no substitute for preventative attention to plumbing and a full awareness of possible coverage gaps. Missing these details can lead to unwelcome cost burdens when ageing pipes fail, so understanding the fine print is indispensable.