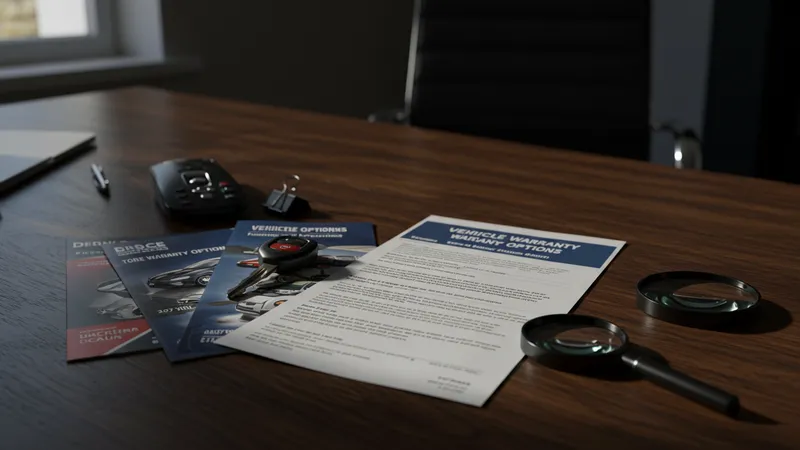

Vehicle Warranty Options : Key Information

Vehicle warranty options refer to a range of protection plans that car owners in the United Kingdom can choose from to cover the cost of repairs and replacement parts should their vehicle suffer mechanical or electrical failure. These options offer drivers peace of mind against unexpected expenses after the manufacturer’s initial warranty expires. Different plans come with varying lengths, coverage details, limits, and pricing, making it essential for vehicle owners to understand the key features before making a choice.

When evaluating vehicle warranty options in the UK, it’s important to consider not only the extent of cover but also aspects such as claim processes, included parts, service provider reputation, and how well the policy matches your particular car’s age and mileage. Each warranty provider structures their offerings uniquely, with some focusing on comprehensive protection and others specialising in more basic cover. Below are the top 10 vehicle warranty options, each recognised for specific strengths and suitability for drivers throughout the UK.

- Warranty Direct: Comprehensive cover from £350 per year.

- RAC Car Warranty: Multiple coverage levels, starting from £170 annually.

- AA Warranty: Flexible plans from £200 per year.

- MotorEasy: Technical and wear & tear cover from £300 per year.

- Car Care Plan: Dealer-backed options, prices typically from £250 annually.

- Evans Halshaw Warranty: Retailer plans, £250–£400 per year.

- Halfords Autocentres Warranty: Used car cover from £200 per year.

- Autoguard Warranties: Frequently bundled with used car sales, £225–£350 annually.

- Carwise Warranty: Parts and labour cover from £230 annually.

- Close Motor Warranty: Dealer-supplied, cover from £275 per year.

Each of these options addresses a different vehicle owner profile. For example, Warranty Direct is known for its comprehensive component cover, making it suitable for drivers seeking minimal exclusions, while RAC Car Warranty provides varied tiered options suiting a wide budget range. Pricing varies based on vehicle make, mileage, and contract length, so careful comparison is required to find the best value for individual circumstances.

The value of choosing a vehicle warranty often comes down to the risk tolerance of the driver and the reliability of their vehicle make. For higher-mileage or older vehicles, warranties such as those from MotorEasy and Car Care Plan offer additional peace of mind by including wear and tear cover, which is not standard across all providers. On the other hand, some plans prioritise lower upfront costs and only cover essential breakdowns, appealing to those with newer cars or lower usage.

It’s also worth considering who underwrites the plan. Warranties backed by major dealers, such as Evans Halshaw and Close Motor Warranty, can deliver greater accessibility for claims and servicing within their network, which may be more convenient for frequent drivers. Meanwhile, trusted names like AA and RAC are favoured for their established customer service and roadside support features that go beyond the policy itself.

Current trends in the United Kingdom also show increased interest in digital-first providers, like MotorEasy, that manage claims and administration online—streamlining the process for a tech-savvy generation. However, regardless of provider, all warranties require careful reading of terms, especially on exclusions and service conditions.

By understanding the nuances between these top vehicle warranty options and how they align with the specific needs of UK motorists, drivers can make informed choices that provide genuine reassurance. The deeper details reveal even more valuable insights ahead, such as what sets comprehensive cover apart and how claims processes compare—insights that can help you feel confident about your vehicle’s protection.